Bloom Insurance

Phone: (800) 591-8343

Fax: (800) 566-7970

E-mail: Andrew@Bloom-Insurance.com

Health / Life / Retirement Solutions / Medicare

Providing Affordable Coverage Without Sacrificing Quality or Benefits

Medicare Made Simple

Many people find Medicare a little confusing. Especially when they’re new to it.

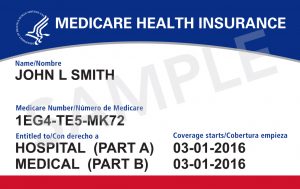

Part A, Part B, Part C, Part D, should you go the Supplemental route or Advantage route?

Which was is best for you? What does it all cost? What are the rules? If you don’t do everything correctly are there time constraints? Are there penalties?

Don’t worry

I’m a duly licensed agent who is certified to offer ALL Medicare products offered by virtually ALL the Medicare providers out there.

I take the time to clearly explain your options, costs, pro’s and con’s of each choice, ensure you’ll continue seeing the doctors of your choice, and answer all of your questions to your complete satisfaction.

Health Care Coverage Made Simple & Affordable

Medical Insurance can be complicated. Bloom Insurance is here to help. Learn about the changing world of plans, premiums and benefits so you can make decisions that make sense for you and your family.

You Do Have Choices

Are you the type of person that only see’s the doctor a couple times per year? Of course you still want to be covered should something unexpected occur.

If that’s you …………. Why Not take advantage of an Off-Exchange Health Care Plan that could save you 40% OFF your monthly premiums? All without sacrificing Quality of Care.

If you require more frequent / on-going care we can help navigate the world of Obama-care and present several solutions that’s tailored to the care you deserve. Our ability to “shop” all the major carriers can result in significant savings.

What About Deductibles? How Will I Pay My Bills If Something Happens to Me?

Yes, your hospital and doctor bills may be covered with your health care plan. but, you’ve still got a mortgage, car payment and other bills to pay while you’re recovering.

Now you can Eliminate those worries. All with incredibly low premiums.

These benefits are paid directly to you — not your doctor or hospital

- Accident: Lump-sum cash up to $25,000 for around $6 per month

- Hospital Confinement: Up to $1,000 daily cash benefit. Premiums starting at $6.26 per month

- Critical Illness: Pays up to $100,000 lump sum cash benefit. Premiums begin at $6.59 per month

- Cancer: Pays up to $50,000 one-time lump-sum cash benefit. Premiums begin at $5.18 per month.

Complete Protection Only Comes With Life Insurance

But, did you know….. some policies come with “Living Benefits”? this is cash available to you in the event of critical illness, chronic illness, critical injury or even cancer.

There are only a few carriers in California who offer those kind of benefits. Thankfully, we are authorized to offer those products to you.

But which product is right for you? Term Life, Whole Life, Universal Life? Each come with their own positives and negatives. A professional should not only be able to describe all the pro’s and con’s of each, but also evaluate your individual needs to help guide you to the solution that makes sense for you and your family.

Retirement Solutions and Insurance?

You bet. Many consider insurance as the cornerstone of their retirement. the kind of insurance that accumulates cash value. The kind that goes up with the market, but never down. Keeping a sizable death benefit while paying you a substantial Tax-Free monthly income.

There are endless ways to configure these types of policies, but it all begins with understanding how they work and what your goals are.

Did you know Annuities can also significantly impact your retirement? I’m not talking about the old kind loaded with risks, fees and miserable returns that only make sense if you have a VERY substantial sum to invest.

This new class of annuity products provide market protection, limited fees and are Designed for Stellar Growth (or income). Sure, you should have money “in the market”, but doesn’t it make sense to diversify with products that only increase in value and are not susceptible to market crashes?

A Solid Protection Plan Can Work Within Virtually ANY Budget.

We at bloom Insurance pride ourselves in providing quality coverage at an affordable price.

We know you don’t want to be “sold” anything. That’s why we take the time to first, listen and understand your goals. Then, painstakingly analyze potential benefits vs. your budget. Only then can we present various optioins and take the time to explain how each product works, so you can make the best, most informed decision for you and your family.

Call Today!

For a Risk Free Evaluation

(800) 591-8343

California Department of Insurance License #0K32441